what is a crypto

Token Burn?

In recent years there’s been a lot of talk around token burns on social media, YouTube, Reddit and other platforms. Token burning became such a hot topic because in the realm of 'altcoins', nearly all projects choose to use this mechanism and boast its benefits.

What is token burning?

Crypto coins and tokens are burned when they are sent to addresses with no owners also known as “eater address”, such as 0x0..0000 on Ethereum Blockchain or 0x0..dea on Binance Smart Chain. When assets reach such an address they can no longer be transferred back to the circulation supply rendering them unusable, a state known as “burnt” or “burned” in the crypto world.

The process of token burn is usually performed by the developers of the crypto asset and might have various reasons, the most common one being the so called “deflationary purpose”. In theory, a decrease in the circulation supply tends to drive the price of an asset upward due to its increasing scarcity.

Another important reason for developer teams to burn tokens is to maintain the price peg of stable-coins. These assets are a class of cryptocurrencies whose value corresponds to another asset, most often the U.S. dollar.

There are other legitimate reasons for burning tokens. Some projects use token burns to avoid spammed transactions, other projects might use burning for fair governance.

Why is this important?

Even if there are legitimate reasons for development teams to burn tokens, there has been an increase in malicious burning of tokens recently by crypto scammers.

The scenario usually involves a relatively new project with few holders and very high levels of total supply.

How it works:

The project Dev Team mints billions of tokens that immediately following launch, they burn more than 50% of the total supply in one or multiple transactions. This activity is then advertised as a deflationary process that will drive the price up which should enable the project to get off the ground, whilst promising huge returns for investors.

In theory, burning some of the circulating supply will increase the price because of the laws of supply and demand. For a young project however, with few holders, and potential investors who are uncertain of its real potential of growth, a sudden decrease of supply in its early stages will usually fail to drive the price up.

So why do developers do this?

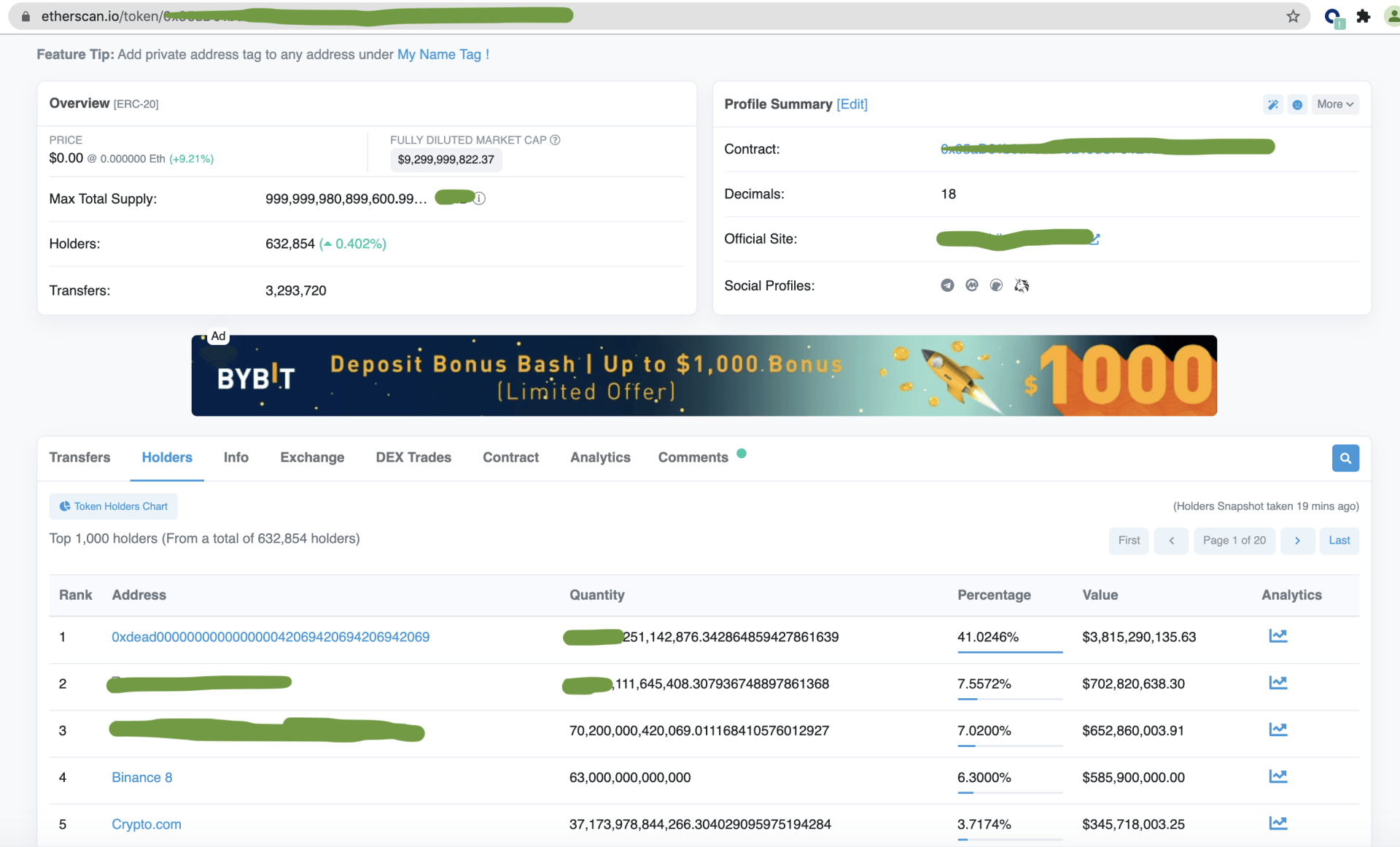

The main reason is to hide the fact that they own a huge portion of the circulation supply. Most popular blockchain explorers present a list of holders ordered by their percentage of the total supply that they own, in descending order.

If you check the holders page and see that a huge percentage of tokens are burned, you will have to calculate for yourself how much the other addresses actually own in terms of percentage from the total supply.

For example, if a token has 90% of the total supply burned, and the creator wallet has 2%, you should consider that in reality, those 2% which might seem low account for 20% of the current circulating supply. If the developers are ill intended, those 20% can be sufficient for a so called 'rug pull' that will most likely cause the value of the token to fall to almost zero.

Other scammers have been even more creative by burning tokens to known people’s wallet addresses - most often Vitalik Buterin. This method brings two benefits, the first one is that the receiver of the tokens might bring attention to the matter and indirectly advertise the asset and start to increase its demand.

The second benefit is a lot more important, the burn will increase the market capitalisation and therefore provides free advertising. Besides the psychological implications that a huge number will have over most unexperienced investors, most coin trackers order their assets by market capitalisation, in descending order. Market capitalisation is calculated as current price multiplied by circulating supply. Since the “burn” was performed to a normal wallet, not a well known eater address, the tracking websites will not register those tokens as burned and will use them in the calculation of the market capitalisation.

So; if a project “burns” 90% of the tokens to a normal address the market capitalisation will be 10 times greater than what it should have been if the tokens were transferred to an eater address - artificially bringing the asset to a higher position in the rank.

Before you invest in a token, do your homework. Consider the history and credibility of the project team, read the

Project White Paper and if it describes a token burn policy, understand the implications for your potential investment before you invest.

Burn baby burn!..

Coinbite is planning an annual 'token burn' event of 10% of our tokens, each year for 10 years to celebrate Bitcoin Pizza Day. This event will be a coming together of $BITE and our NFT holders to eat pizza, share a few drinks and generally share the good word about crypto as well as updates from our Dev Team.

Could this impact the token price for $BITE holders? Time will tell!

Spoiler Alert:

Token Price = Market Cap/Circulating Supply

RISK WARNING: Cryptocurrency is not currently regulated by the UK Financial Conduct Authority and is not subject to protection under the UK Financial Services Compensation Scheme or within the scope of jurisdiction of the UK Financial Ombudsman Service. Investing in cryptocurrency comes with risk and cryptocurrency may gain in value, or lose some or all value. Capital gains tax may be applicable to profits from cryptocurrency sales. Check with a professional adviser before investing. YOU MAY LOSE ALL THE MONEY YOU INVEST!.

Neither Coinbite Limited nor this website intends, and nor does it, provide investment, financial, legal, or regulatory advice at any time. Nothing on this website should be construed as a recommendation by

Coinbite Limited, its affiliates, or any third party, to acquire or dispose of any investment, or to engage in any investment strategy or transaction in any jurisdiction in which such offer, solicitation or sale would be unlawful. It is the responsibility of the user to ascertain whether they are permitted to use the services of Coinbite® based on the legal requirements in their country of residence.

All financial investing involves a high degree of risk and Capital is ALWAYS AT RISK. Remember to always DO YOUR OWN RESEARCH before making any investment decisions.

All third party partners providing financial services through this or other Coinbite® websites are vetted to ensure registration with their relevant financial services authorities. They must operate in full compliance with European regulation on Anti Money Laundering (AMLD5) and adheres to the GDPR for the highest standards in data protection.

Coinbite | 20 Crewe Road, Sandbach Cheshire CW11 4NE.

Coinbite®

and the

Coinbite Logo

are licensed

registered trademarks

Coinbite® All Rights reserved